The Back of Time’s Head and the 4.6% Signal

I. The Choir of Small Penguins

It was my twins’ first school performance for the holidays. Every kid was dressed in a binary harmony—black bottoms, white tops—standing on the step-risers like a grand church choir, though they were barely tall enough to reach the microphone stands. The stage was decked out with the kind of flat, primary-colored Christmas decorations you’d see in a Sunday morning cartoon from 1980.

The parents stood in the dark auditorium, their eyes starry, focused solely on their own offspring. It is a strange biological imperative. A hundred children are singing, but you only hear two. All the kids looked adorable, of course, but through the distorted lens of my own bias, my twin girls looked like the only real things in the room. Precious, finite, and fleeting.

I tried my best to catch every single moment, to record it on the magnetic tape of my memory, knowing that someday I will terribly miss this. I couldn’t stop smiling, but deep in my chest, there was a specific weight. A tenderness. It was somewhat nostalgic, even though the moment hadn’t passed yet.

To put it in simple context: Sad, but happy.

It was the kind of sadness that feels like a warm stone in your pocket. You know it’s there, weighing you down slightly, but its warmth is the only thing proving you are alive.

II. The Angle We Cannot See

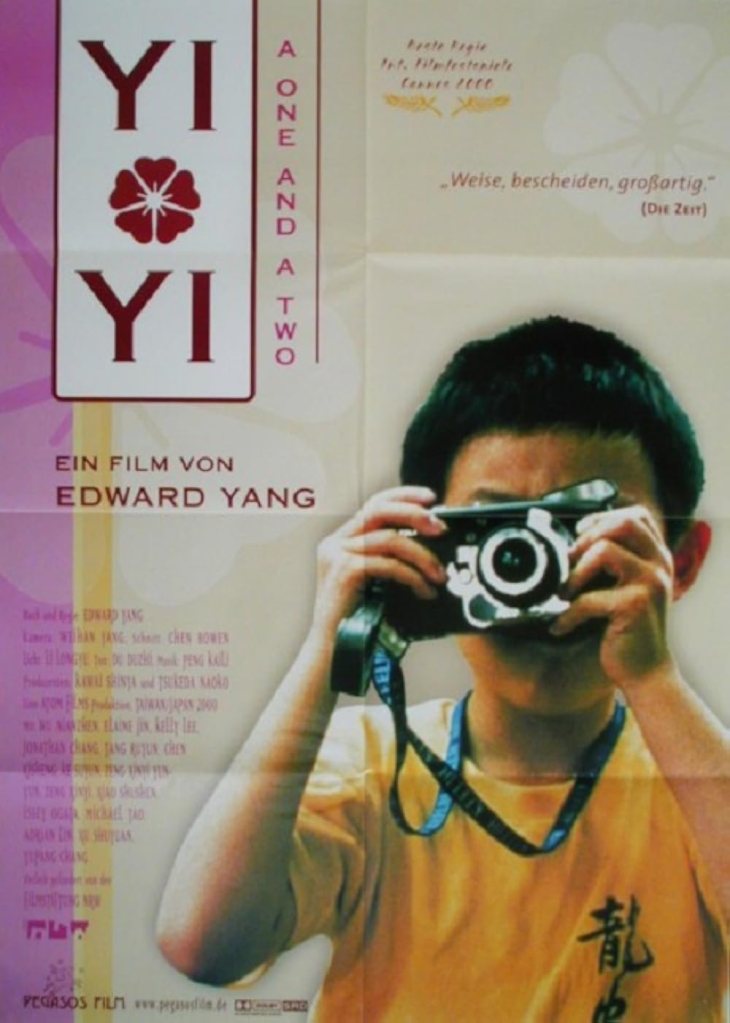

It reminded me of a scene from Edward Yang’s film, Yi Yi.

There is a young boy in the movie, Yang-Yang, who goes around taking photographs of the backs of people’s heads. When asked why, he simply says, “You can’t see it yourself, so I’m helping you.”

We walk through life seeing only what is in front of us, blind to our own trailing shadows, blind to the “back” of our own existence. Standing there, watching my daughters sing about snowmen and reindeer, I realized I was trying to photograph the back of Time’s head. I wanted to see the angle that is usually hidden—the future that was rushing toward them, the past that was slipping away from me.

The financial market, in its own cold, numerical way, attempts the same impossibility. It tries to capture the invisible momentum of the world through a lens called “Data.” It tries to show us the back of the economy’s head—the parts we miss because we are too busy living inside it.

Today, on December 16, the lens focused, and the picture it took was blurry, complicated, and undeniably shifting.

III. The Report: Examining the Photograph (December 2025)

We finally received the delayed employment data for October and November. Like a film developed late, the images are grainy due to the government shutdown, but the contours are visible. And what we see is a structural shift.

1. The “Efficiency” Shock (The Public Sector Purge)

The headline number for November Non-Farm Payrolls came in at +64,000, beating the muted expectation of 50,000. But the real story is in the “back of the head”—the revisions and the sector breakdown.

October saw a massive drop in government employment—162,000 jobs vanished. This is the direct result of the “efficiency department” activity (the so-called DOGE initiative). We are seeing the physical manifestation of the new administration’s policy: trimming the fat, which inevitably means firing the butcher. November stabilized with only a 6,000 decrease, but the structural damage to public sector headcount is done.

2. The Unemployment Tick (4.6%)

The unemployment rate has risen to 4.6%, up from the expected 4.5%.

In a vacuum, rising unemployment is a recession alarm. However, looking closer, the rise is partly due to an increase in Labor Participation. More people are entering the frame of the photograph, looking for work. When the denominator grows, the rate rises. This is not the “death spiral” of demand destruction; it is the “adjustment friction” of a changing labor supply.

3. The Death of Inflation (Wages +0.1%)

If you needed proof that the inflation dragon is dead, this is it. Average hourly earnings rose by a microscopic 0.1%.

Wage pressure has evaporated. For the Federal Reserve, this is the green light. The argument that “a strong labor market will reignite inflation” is now null and void. Income is barely keeping pace with life; there is no spiral here.

4. The “Goldilocks” Retail Data

Just as we started to worry about the consumer, Retail Sales (Control Group) posted a surprising +0.8%. The consumer is not dead; they are just selective. They are spending, but they are not getting raises. It is a precarious balance, but for now, the engine is running.

I know by heart, I am going to miss this day. Going to miss the smiles, the eyes, the looks, the exciting voices, the comforting hugs, the proud looks on their faces…

Disclaimer: Memories are subjective, and so is data. Invest with eyes on the horizon, not just the rearview mirror.

IV. Conclusion: The Soft Landing is a Quiet Room

The performance ended with a sudden, chaotic burst of applause. The children on the risers bowed, some out of sync, some too deep, all of them smiling that unguarded smile that adults lose somewhere between their first tax return and their third heartbreak.

My twins found me and my wife in the crowd and waved. In that gesture, I saw it again—the passage of time. They were no longer the toddlers I carried; they were small people with their own gravity, drifting slowly away from my orbit into their own.

The market’s reaction today—10-year yields drifting down to 4.14%, futures pushing slightly higher—is the financial equivalent of this moment. The chaotic noise of the post-pandemic boom has faded, replaced by a polite, measured applause. The “Civil War” at the Fed is ending. With unemployment at 4.6% and wages flat, the aggressive tightening is over. A January Rate Cut is no longer a debate; it is a necessity.

We are entering a phase that feels much like the auditorium as the parents begin to stand up and put on their coats. The “inflation scare” has exited the stage. The drama is finished. What is left is a quieter, slower economy.

Is it a recession? The retail numbers say no.

Is it a boom? The unemployment numbers say no.

It is simply stabilization. It is the “sad but happy” equilibrium.

The exuberance of the child is gone (sad), but the stability of the youth has arrived (happy). The economy, like my daughters, is growing up. It is becoming cooler, calmer, and more predictable.

As I walked out of the school into the cool December air of Los Angeles, holding my wife’s hand, I realized that this is what a “Soft Landing” actually feels like. It isn’t a victory parade. It’s just the relief of knowing that the crash didn’t happen, and that we all get to go home, have dinner, and prepare for whatever comes next.

Disclaimer: Memories are subjective, and so is data. Invest with eyes on the horizon, not just the rearview mirror.

Leave a comment