The Wind, The Parrots, and the Memory of Light

I. The Advisory

Today, a “Wind Advisory” was issued for Los Angeles. It started at noon and will last until 10:00 PM. The report warns of gusts up to 50 miles per hour in the hills—invisible hands shaking the power lines, threatening to snap the fragile connections that keep the city lit.

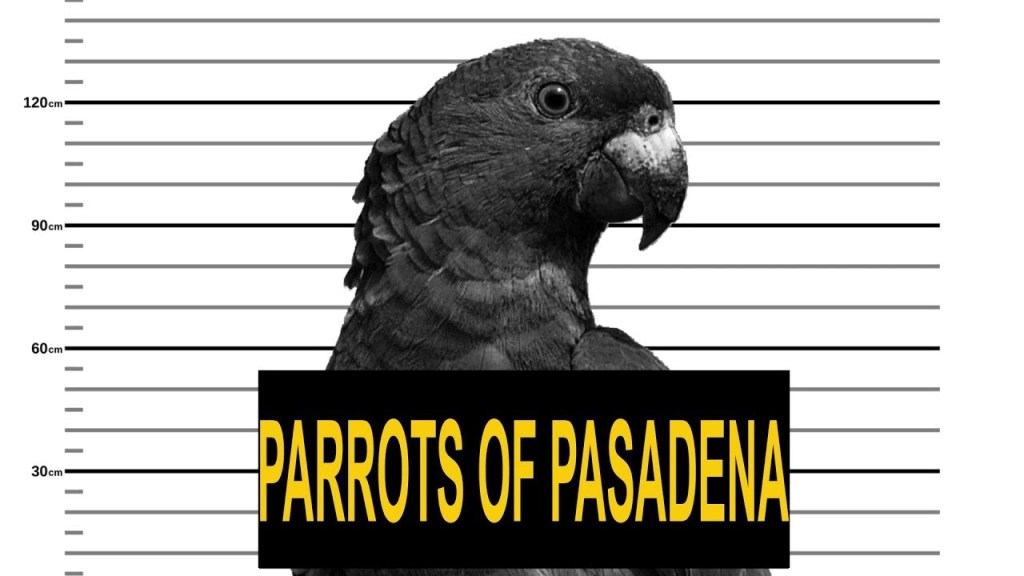

I went out to the backyard to tighten up the yard furniture and the kids’ toys. The air was dry and restless, stripping the moisture from the leaves of the potted plants. It reminded me of the wild parrots of Pasadena.

I read today that they have decided to roost at City Hall this year, a chaotic green cloud descending on the seat of order. They are descendants of escaped pets from decades ago, living ghosts of a domestic past that have learned to survive in the wild. They scream from the trees, indifferent to the traffic below, existing in a parallel world of pure instinct.

The wind and the parrots. Both are forces that belong to the city but feel alien to it. They arrive without an invitation, disrupt the silence, and remind us that control is just a story we tell ourselves to sleep at night.

The stock market today was exactly like this wind. A sudden, invisible gust that shook the “AI trade” until the lights flickered. We have been living in a domestic dream of endless capital, but today, the wild parrots came home to roost.

II. The Flicker (The AI Sell-Off)

The S&P 500 fell 1.16%, breaking below its 50-day moving average—a technical line in the sand that traders treat like a religious boundary. When we cross it, the mood shifts from “buy the dip” to “protect the house.”

The gust started with Oracle. The news broke that Blue Owl Capital—the financier behind Oracle’s massive AI data center project—had flown away. They looked at the debt, looked at the risks, and decided the wind was blowing too hard. Oracle shares dropped 5.4%.

Then came the “circular trade” anxiety. Amazon is reportedly investing $10 billion in OpenAI, but with a catch: OpenAI must use Amazon’s chips. It is money moving in a circle, a snake eating its own tail. The market looked at this and asked: Is this real demand, or just accounting magic?

Nvidia fell 3.8%. Broadcom fell 4.5%. The “Santa Rally” began to look less like a sleigh ride and more like a car skidding on ice.

III. The Memory of Light (Micron’s Earnings)

But then, after the sun went down and the market closed, a different kind of signal emerged.

Micron Technology ($MU) released its earnings report. In the darkness of the post-market, the numbers glowed like neon.

- Revenue: $13.64 billion (up 57% year-over-year).

- EPS: $4.78 (beating expectations of $3.96).

- Guidance: Q2 revenue forecast at $18.7 billion, smashing the consensus of $14.4 billion.

Micron is the “memory” of the AI brain. It stores the light that the processors create. And Micron is telling us that the brain is still hungry. Demand for HBM (High Bandwidth Memory) is so strong that they have sold out their entire supply for 2025 and 2026.

The stock jumped 7% in the after-hours, a sudden burst of illumination in a dark room. It was a reminder that while the financiers (Blue Owl) are worried, the engineers are still building. The wind may be shaking the lines, but the current is still flowing.

IV. Conclusion: The Two Winds

So we are left with two conflicting winds.

One is the Financial Wind—the fear of debt, the “Blue Owl” leaving, the breaking of the 50-day moving average. This wind says: Winter is coming. Retreat.

The other is the Physical Wind—the Micron earnings, the sold-out inventory, the sheer undeniable demand for memory. This wind says: The machine is still running hot. Stay.

I sat back down at my kitchen table. The wind outside was still howling, rattling the window pane. I thought about the parrots in Pasadena, huddled together in the trees, green feathers against the gray sky. They don’t know about stock prices or interest rates. They only know that when the wind blows, you hold on tighter to the branch.

For now, that is the strategy. We hold on. We watch the 50-day line. We respect the wind, but we do not let it blow us away.

Speaking of things hidden in plain sight, a man in Miami was arrested today for collecting his dead mother’s Social Security checks for four years. He kept her accounts active, a digital ghost living on in the banking system long after the body was gone. It makes you wonder: How much of the market is just a digital ghost, collecting checks from a reality that no longer exists? Or perhaps, like the man in Miami, we are just hoping no one checks the expiration date.

Disclaimer: Winds change. Parrots bite. Invest accordingly. And watch out for the expiration dates.

Leave a comment