PJ Day on Wall Street: Finding Comfort in Uncertain Reality

I. The Flimsy Chaos

It was a busier morning than I expected today. Maybe it was because of the last day of school. Maybe I was trying a bit too much to prepare snacks and lunches, aiming for a perfection that no one asked for. There was a point where I almost ruined the morning by letting my frustration spill over, a sharp word ready to launch.

Then, I stopped.

I stopped doing everything for exactly three seconds. The kitchen was a hell of a mess—open jars, scattered crumbs, half-packed bags. But in those three seconds, which might have been wasted on an emotional letdown, I used the silence to turn around. I looked away from the flimsy, unimportant chaos and refocused. And there it was: PJ Day.

The kids were standing there in their baggy pajamas, excited to go to school. Their excitement was the only real thing in the room. My “trouble” from three seconds ago, which felt like the whole world throwing knives at me, suddenly seemed like a joke. The snacks were packed. The sun was coming out early, far from the damp and foggy mornings of the past few days.

I realized I didn’t need to fight the chaos; I just needed to tune it out.

II. Clear the Mechanism

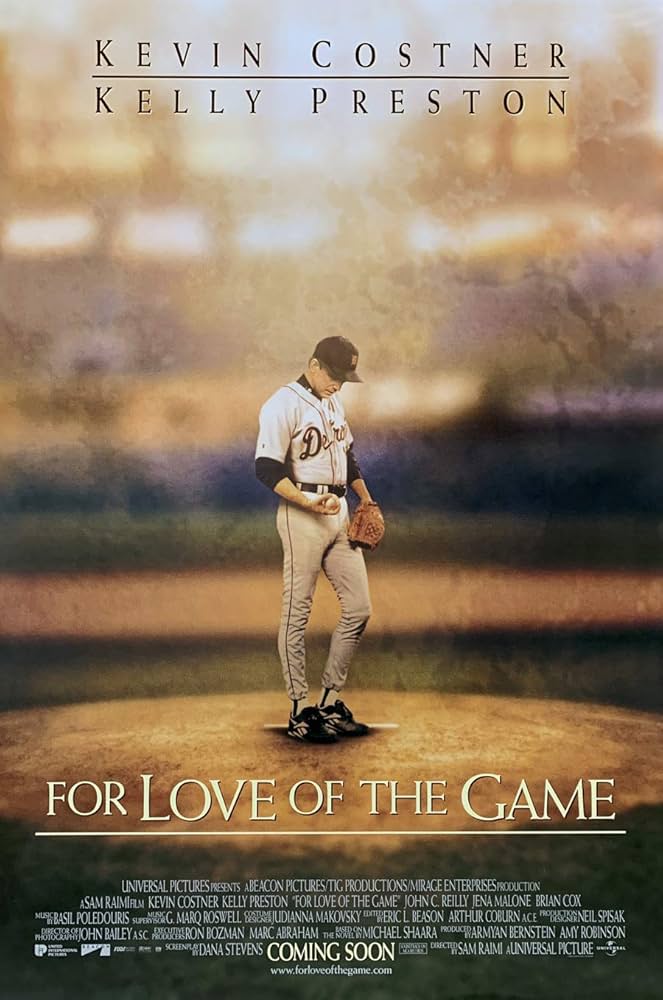

It reminded me of the pivotal scene in Sam Raimi’s film, For Love of the Game.

Billy Chapel, the aging pitcher played by Kevin Costner, stands on the mound at Yankee Stadium. The crowd is screaming, the hecklers are vicious, and the pressure is suffocating. He is in the middle of a perfect game, but the noise is deafening.

Then, he says: “Clear the mechanism.”

Suddenly, the sound drops out. The crowd blurs into a soft, static gray. The only thing left is the catcher’s mitt. The noise is still there, but it no longer touches him.

Watching the financial news this morning, I felt the same need to “clear the mechanism.” The screen was filled with the screaming fans of the financial world—the bears, the bulls, the political analysts—all shouting about the “Money Printer,” the debt, and the coming crash.

III. Clearing the Mechanism: The Signal in the Static

I turned on the screen to watch a financial analysis segment on Yahoo Finance. The analyst on screen was sharp, cynical, and undeniably compelling. He wasn’t celebrating the news; he was dissecting it with a surgeon’s cold precision.

He pointed to the November CPI (Consumer Price Index) headline number of 2.7% and the Core CPI of 2.6%. To him, these numbers were a “wild fantasy.” He argued passionately that the Federal Reserve has quietly turned the “money printers” back on—to the tune of $40 billion a month—masking the real devaluation of currency. He was the heckler in the stands, shouting, “The game is rigged!.”

I respected his view on the “money printer” logic. But as I watched the green tickers slide across the bottom of the screen, I chose to “clear the mechanism.” While the analyst saw a lie, I saw a permission slip. The market doesn’t care about the morality of the money supply; it cares about the rules of the game for today. And just like I ignored the mess in the kitchen to focus on the kids, the market is ignoring the noise to focus on the specific opportunities on the field:

- The “Widowmaker” Blinks (Bank of Japan): Overnight, the Bank of Japan raised rates to 0.75%, a 30-year high. The crowd screamed (briefly), fearing a collapse of the Yen carry trade. But the market cleared the mechanism. The Nikkei absorbed the hit. The global system didn’t break. The “chaos” turned out to be flimsy.

- The Weak Links (Nike & FedEx): Nike (NKE) is the cautionary tale, down 10% this morning due to a 17% drop in China sales and tariff woes. FedEx (FDX) beat on revenue but missed on margins. These are the “messy counters” in the kitchen—real problems, but contained.

- The AI Resurrection (Nvidia, Oracle, Micron): While Nike stumbled, the AI sector decided to fly. Nvidia (NVDA) is up 3.5% ($179.80) on rumors of relaxed China export rules (H200 chips). Oracle (ORCL) is surging 8% on reports of a joint venture with ByteDance (TikTok). Micron (MU) is up another 7% today, still riding the “sold out through 2026” narrative. The message is clear: The AI trade isn’t dead; it was just reloading.

IV. Conclusion: The Sun Comes Out

I finished packing the lunches and we walked out to the school. The street was already filled with other families, a parade of plaid flannel, onesies, and fuzzy slippers moving toward the school gate. There was a collective lightness in the air, a shared permission to let go of the stiff rules of the week.

The market today feels exactly like this PJ Day. It isn’t messy; it is comfortable. It has decided to stop wearing the tight, uncomfortable suit of “Macro Fear” and slip into something that feels good. The mess in the kitchen—the Nike earnings, the FedEx margins—is still there, behind the closed door. But out here, in the sun, the AI stocks are running free.

As I watched my kids merge into the sea of pajamas, laughing with their friends, I realized that the “mess” doesn’t disappear, but it also doesn’t have to define the day. The 2.7% CPI is the sunlight. The 3.5% gain in Nvidia is the permission to relax.

We can stay in the kitchen and stare at the crumbs, or we can step outside and enjoy the comfort.

I choose the comfort for today. Because from tomorrow, the winter break is on. No more comforts for the next two weeks.

Market Snapshot (Morning, Dec 19, 2025):

- CPI: 2.7% (Cooler than expected).

- Nvidia: Up 3.5% on China export hopes.

- Oracle: Up 8% on TikTok JV news.

- Nike: Down 10% on China weakness.

- Sentiment: Clearing the noise, focusing on the soft landing.

Disclaimer: Invest with a clear head. The crowd is always screaming about something.

Leave a comment