The morning arrives with a stillness that feels like a held breath. The sunlight is a heavy, golden syrup that clings to the palm trees, motionless and indifferent. The air is stagnant and warm, unblinking clarity. I sit by a window, watching the way the light catches the dust motes, making them look like tiny, suspended galaxies. The S&P 500 is hovering near 6,960, a number so lofty it seems to exist in a different atmosphere. It is a morning of record highs and hollow silences—Goldman Sachs and PNC have reported “blowout” numbers, yet the Dow remains flat, as if the market is waiting for a signal that hasn’t been made yet.

The Alchemy of the Tweezer

The market isn’t rising because the world has found its footing; it is rising because the Federal Reserve has mastered the art of the invisible mend. My thesis is that we have moved past the era of the “flood.” We are now in the age of the RMP (Reserve Management Purchases)—a precision IV drip of liquidity.

In Christopher Nolan’s Inception, there is a basement where the dreamers go to be sedated, overseen by a chemist who knows exactly how many milligrams it takes to keep the dream stable. The Fed is that chemist.

By purchasing short-term T-bills while the Treasury keeps long-term rates tethered like a captive balloon, they have created a “tweezer” strategy. They aren’t trying to save the whole forest anymore; they are just keeping the most important trees from turning brown. It is why the 43-day government shutdown didn’t trigger a collapse—the basement was still being pumped with just enough reality-distorting fluid to keep the eyes closed and the charts green.

The Mirages and the Machines

In the slow-motion frames of a film like Wong Kar-wai’s Chungking Express, there is a sense of things left unsaid—the way characters move through a space where the atmosphere is thick with a longing for a future that hasn’t arrived. We are living in that space.

At CES 2026 last week, the “arrangement” of our reality was revealed to be silicon and steel. Hyundai and Boston Dynamics showcased the Atlas humanoid, not as a prototype, but as a production-ready industrial worker.1 Nvidia’s Vera Rubin superchips are now the silent engines of our collective thought.

We are told that AGI is effectively complete, a monolith of intelligence that promises a productivity miracle. Yet, Elon Musk warns of a “valley of shadows”—a 3-to-7-year transition where the labor market might freeze, leaving a generation standing in the gaps between the old world and the new. The friction is already visible. Just this morning, news from the Middle East indicates that the tension between Israel and Iran is no longer a slow burn but a sharpening edge, while the Trump administration—now a 10% stakeholder in Intel—prepares for a pivot in trade policy that could disrupt the very “precision” the Fed is trying to maintain.

Conclusion: The Edge of the Set

The stillness outside the window reminds me of the ending of Blade Runner 2049.

K lies on the steps as the snow falls—cold, silent, and indifferent. He has protected a secret that keeps the world turning, even if that world is a dying one. We are in that same quiet transition, ensured by the Fed and the Treasury lying on the steps of the economy.

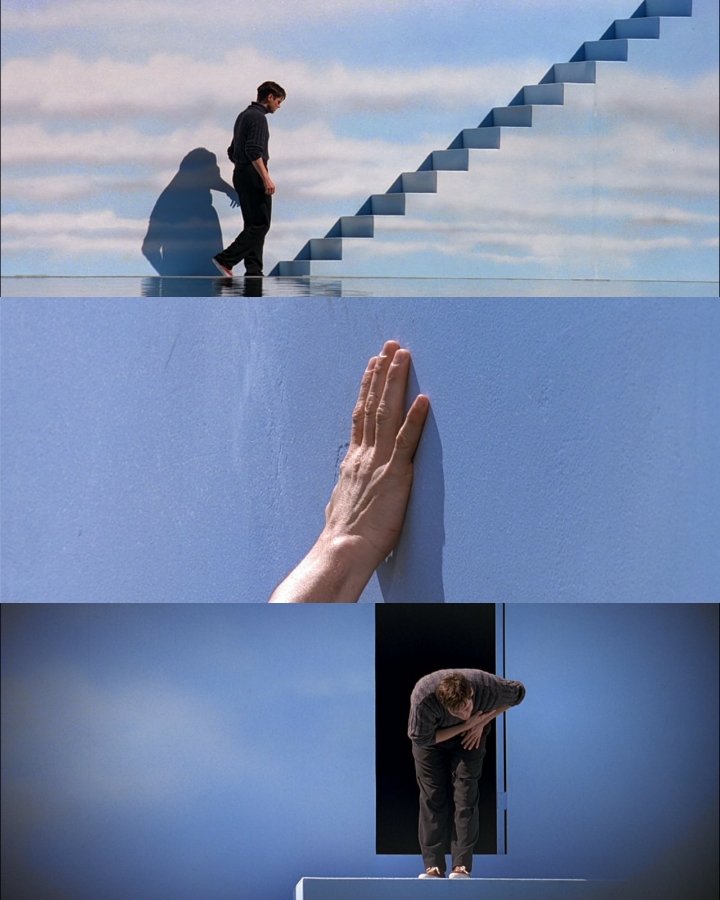

But perhaps the more fitting image is the final moments of The Truman Show.

Truman reaches the edge of his horizon and realizes the sky is just a painted wall. He finds the door in the blue paint and bows to the invisible audience before stepping out into the unknown.

We are currently walking toward that wall. The market is perfect, the weather is still, and the liquidity is precise—but we are starting to see the brushstrokes in the sky.

I finish the last of my coffee. It is entirely cold. Outside, the stillness of Los Angeles remains—an indifferent silence to the numbers flickering on my screen.

_____________________________________________________________________________________________

A Note Before the First Sip (hence, a disclaimer)

Writing about the economy is a bit like trying to catch a talking cat in a dark alley—you’re never quite sure if you’re chasing a reality or a projection of your own loneliness. The numbers I’ve laid out here are as real as the ramen I’ll probably boil tonight, yet as fragile as a glass ornament in the hands of a toddler. This is not financial advice. It is simply a report from my corner of the world, where the coffee is cold and the logic is surreal. If you choose to act on these thoughts, do so with the understanding that the wind can change direction without warning, and sometimes the well is deeper than it looks.

Leave a comment