The markets had been a long, cold shadow for most of the day, dipping sharply with a heavy, leaden finality. Then, in the final hour, something shifted—not a roar, but a quiet change in the wind—and the numbers began to climb back up, ending the day with a gain so miniscule it felt more like a clerical error than a victory. It was mostly the Greenland fiasco, one of those strange, surreal headlines from the Trump administration that makes you feel as if you’ve stepped into a world with two moons.

Many of my major positions had been shaken loose during the dip, and I spent the evening reshuffling weights and moving funds, like a man trying to reorganize a library in the dark. Sometimes I wonder how much of a difference I really make, sitting here monitoring charts and making adjustments to individual stocks. I remind myself that I am still learning, that it hasn’t even been a year since I began this dance. But even the experts—the men who have lived in this game for decades—speak in a chorus of contradictions. Some say you should never sell, only keep buying until the world ends. Others say that holding a declining stock is a test of character. As Mark Hanna says in The Wolf of Wall Street:

“Number one rule of Wall Street. Nobody — and I don’t care if you’re Warren Buffet or if you’re Jimmy Buffet — nobody knows if a stock is going to go up, down, sideways or in circles.”

It is a confusing sort of music, but as I sat there watching the final tickers fade, I realized that these contradictions aren’t just noise. They are the gears of a much larger, invisible machine. We think we are making choices, but we are often just responding to the turn of a distant wind-up bird.

The Wind-Up Bird and the Election Tide

There is a judge waiting at the end of this year, a judgment on everything that has been built since the administration first took power. To ensure the verdict is kind, the people behind the curtain are working to make sure the floor never falls out from under us. They are propping up the market with the same desperate, late-night tension found in Margin Call. As Will Emerson says in the film:

“The only reason that they all get to continue living like kings is because we got our fingers on the scales in their favor. I take my hand off, and then the whole world gets really fuckin’ fair really fuckin’ quickly, and nobody actually wants that.”

If you look closely at the trade deals, the harsh, cold edges of the high tariffs have begun to soften, like a piece of wood worn smooth by the sea. The nominal 20% tariff that everyone feared has quietly settled into a real rate of 10.7%, a number reached through the quiet, back-room negotiations that favor stability over spectacle. It reminds me of the secretive, calculated power portrayed in Vice—the kind of quiet man who waits for the right moment to strike. When the world asks if the cost is worth it, the answer is often a cold, single word: “So?”

Shadow Easing: The Invisible River

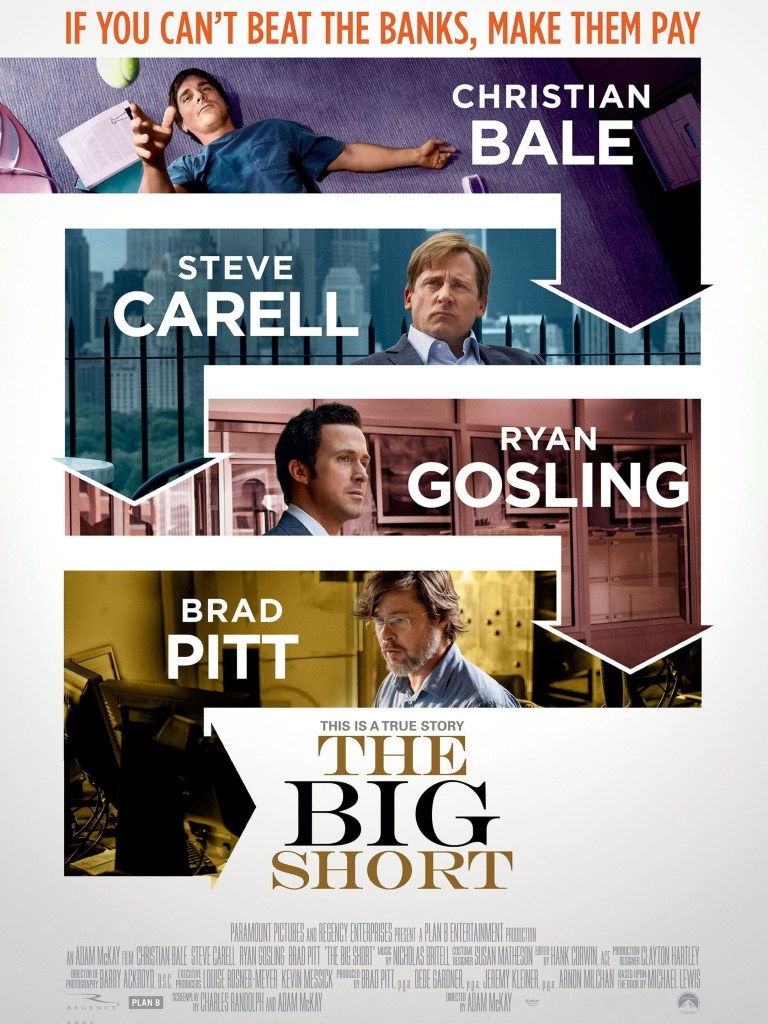

Beneath the surface, there is a river of money flowing through a place the experts call “Shadow Easing.” It’s a mechanism as intricate and hidden as the credit default swaps in The Big Short,

where things are not what they seem. Through something called the Genius Act, the government is inviting stablecoin issuers into the fold, encouraging them to buy short-term Treasuries. It’s a way of expanding the wallet without ever opening it in public. As the screen text in the movie reminds us:

“Truth is like poetry. And most people fucking hate poetry.”

This liquidity is a ghost in the machine, much like the Money Market Funds of 1971 that remained invisible to official records for nine long years. We are living in a blind spot, where the true face of inflation is hidden behind a mask of digital coins and shadow credit. It echoes the manic, deceptive energy of Belfort’s trading floor: “It’s all for naught… It’s just money; it’s made up. Pieces of paper with pictures on it so we don’t have to kill each other just to get something to eat.”

The Housing Well and the Fed’s Hand

In the world of real estate, the administration is digging a deep well, hoping to find a passage that bypasses the cold, distant hearts of the Federal Reserve. They have signaled a plan to order quasi-government agencies—Fannie Mae and Freddie Mac—to purchase $200 billion in Mortgage-Backed Securities. It is a direct attempt to force the mortgage rates down, a masterstroke of pressure that leaves the Fed with no choice but to pour more liquidity into the system to keep the short-term markets from seizing up. It’s a morality play of regulators and politicians, much like the one exposed in the documentary Inside Job:

“This was not an inevitable crisis. It was a crash caused by pilot error… The guys who wrecked the train cannot get the train back on the track.”

By forcing the Fed to respond to this artificially created stress, the administration ensures that the “pilot” continues to fly the plane exactly where they want it to go, regardless of the long-term structural damage.

Conclusion: The Management Phase

Everything is being managed now, from the $2.5 trillion in potential banking capacity to the careful tuning of the stock market’s engine. We are in a management phase, a pre-election concerto where every note is rehearsed and every risk is accounted for. The record is spinning, the music is playing, and for a brief moment, the world feels as if it could stay this way forever. As Jordan Belfort bellows to his troops in his most desperate hour:

“I want you to deal with your problems by becoming rich!”

But even in the quiet hours of the night, when the numbers stop moving, the rain eventually returns to the window, revealing the things we tried so hard to hide. The wind-up bird keeps turning, and we simply wait to see what happens when the music stops.

Disclaimer: I should tell you that I am not a financial advisor. I am just a man who watches the sunset and listens to the occasional jazz record while the numbers on the screen move in their own strange, syncopated rhythm. This world is full of mirrors and deep wells, and what looks like a solid floor today might just be a suggestion tomorrow. Before you go jumping into any dark wells or shifting your life savings into the invisible river, please consult with a professional who understands the hard, cold mathematics of this reality. I cannot be held responsible for the things that happen when the music stops and the two moons finally reveal themselves.

SUMMERY:

The 2026 Evaluation: The mid-term election is not just a date; it is a judgment on the aggressive policies of the administration’s first year.

Preventing the Fall: To ensure a favorable outcome, every economic risk is being suppressed to prop up asset prices. It is a high-stakes performance, reminiscent of the 24-hour tension in Margin Call, where a system on the brink must be held together by any means necessary.

The Genius Act and Stablecoins: Through the Genius Act, the administration incentivizes stablecoin issuers to buy short-term Treasuries, effectively expanding the government’s wallet.

The MMF Blind Spot: This new liquidity is a ghost in the system. Just as Money Market Funds (MMFs) existed in a “blind spot” for nine years (1971–1980) before being captured in M2 supply metrics, today’s stablecoin expansion hides the true face of inflation.

Psychology of the Market: Much like the frenetic energy in The Wolf of Wall Street, this environment thrives on the psychology of power and the expansion of “shadow credit” through DeFi ecosystems.

Direct Intervention: A planned order for quasi-government agencies to purchase $200 billion in Mortgage-Backed Securities (MBS) aims to lower mortgage rates directly.

Forcing the Easing: This move creates a “stress” in short-term markets that leaves the Fed with no choice but to provide liquidity (via RMPS), a masterstroke of indirect pressure. It is a morality play of regulators and politicians, much like the one exposed in the documentary Inside Job, where the public is often oblivious to the gears turning behind the scenes.

Leave a comment