The Tramp’s Shoes

One of the silly, cute things my kids do these days is walking in daddy or mommy’s shoes. I hear them before I see them—the slap-slap-slap of leather soles hitting the hardwood, a rhythm too slow and heavy for a Thursday evening.

They walk like penguins, knees locked, arms out for balance, drowning in the empty space of the heels. More often than not, they fall down. A soft thud, followed by the specific, breathless silence that precedes either tears or laughter. Tonight, it was laughter.

“You got big shoes to fill,” I said, repeating the old saying like a worn-out cassette tape. They don’t understand what it means yet.

But as I watched them stumble, the laughter felt thin. I looked at the shoes—dark, hollow things resting by the door. They looked like small boats waiting for a tide that might never come. It struck me then that “filling shoes” isn’t about growing feet. It’s about inheriting the weight of the steps taken before you. It’s about walking into a room where everyone expects you to know the dance, but the music is something you’ve never heard.

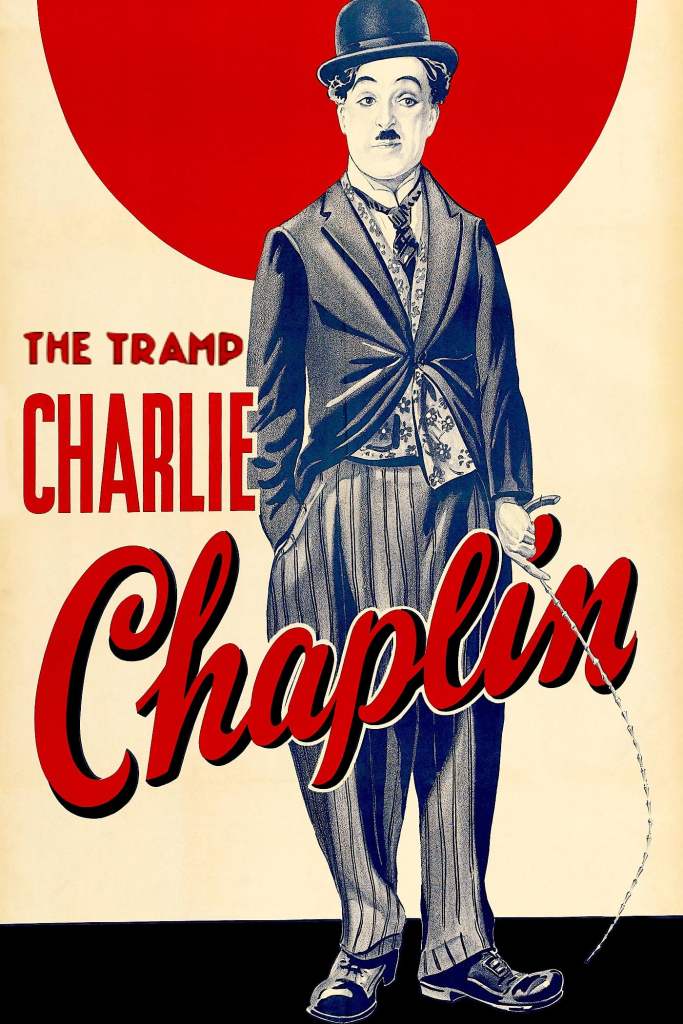

It reminded me of The Tramp—Charlie Chaplin’s eternal wanderer. He always wore shoes that were too big and trousers that were too baggy. He was a man trying to fit into a world that had no precise shape for him. He stumbled, he slid, he fell with a grace that made the falling look like flying. He understood that the only way to survive the crushing machinery of the modern world was to treat the oversized shoes not as a burden, but as a prop for a comedy he was writing in real-time.

Today, the stock market felt exactly like that. A clumsy giant trying to walk in shoes that suddenly felt two sizes too big.

1. The Stumble of the Oracle

I watched the screen as the sun went down. The numbers were red, blinking like tired eyes.

Oracle ($ORCL) was the first to trip. It fell 10.8% today, closing below $200. Yesterday, it was the king of the cloud; today, it was just a company spending $50 billion on data centers that haven’t paid off yet. The market looked at Oracle’s massive capital expenditure and whispered, “Are you sure you can fill those shoes?” The answer, for today, was a resounding no. The “AI Bubble” fear is back, colder and sharper than before.

2. The Broadcom Pivot

Then, after the closing bell, Broadcom ($AVGO) stepped onto the stage.

They reported earnings that were supposed to save the day. And in a way, they did.

- Revenue: $18.02 billion (up 28% year-over-year).

- EPS: $1.74 (beating expectations).

- AI Revenue: Up 74%, driven by custom chips for the hyperscalers.

But the stock fell ~2% in after-hours trading. Why? Because the shoes are getting bigger. The market doesn’t just want growth; it wants perfection. Even a beat feels like a stumble when the expectations are set by the gods. Broadcom is doing the heavy lifting—building the roads for the AI future—but the toll collectors are getting impatient.

3. The Quiet Inflation

I checked the PPI (Producer Price Index) data for November. It came in slightly hotter than expected, a reminder that inflation is a ghost that haunts the house even after you’ve exorcised it. The Fed cut rates yesterday, trying to grease the wheels, but the machine is still grinding.

4. The Yoga Pose

Lululemon ($LULU) also reported. They beat earnings ($2.59 EPS vs $2.22 expected), but the CEO is stepping down. The stock popped, then wavered. Another transition. Another pair of shoes left empty, waiting for someone new to step in and try not to trip.

Conclusion

I picked up my shoes from the hallway and placed them on the rack. They looked smaller now, just leather and rubber, stripped of the metaphor.

The market will open again tomorrow. Oracle will try to stand up. Broadcom will try to explain that 28% growth is actually good. We will all put on our shoes, whether they fit or not, and do the penguin walk into the future.

As Chaplin taught us, the trick isn’t to stop falling. The trick is to stand up and tip your hat as if the fall was part of the act all along.

It’s been a long day but a good day. Must go to bed for the 5am run.

Disclaimer: I am not a financial advisor. I am just a man watching the shadows lengthen in the City of Angels. Do your own research.