The Light Inside the Door and the Memory of the Market

I. The Open Door

I couldn’t wake up to go for a run this morning. The bed felt like a warm island, and the world outside was an ocean I wasn’t ready to swim in. While I stole an extra twenty minutes of sleep, one of my kids, Hunter, took advantage of this rare early morning window. She woke up earlier than usual, perhaps sensing the shift in the house’s rhythm, eager to claim the undivided attention of both me and my wife.

Of course, I woke up with her happily. The run could wait; the childhood could not. Maybe this was why I didn’t go. My wife brought Hunter to the front door, which she had already opened, and pointed a finger toward the sky.

“Wow.”

As soon as Hunter saw the scenery, she instantly fell in awe of it. It was truly magical. Not only the morning scene outside, where the sun touched the world with such gentle care, illuminating the mist from yesterday’s storm, but also the look on Hunter’s face. Her eyes widened, reflecting the light, her small mouth forming a silent “WOW.”

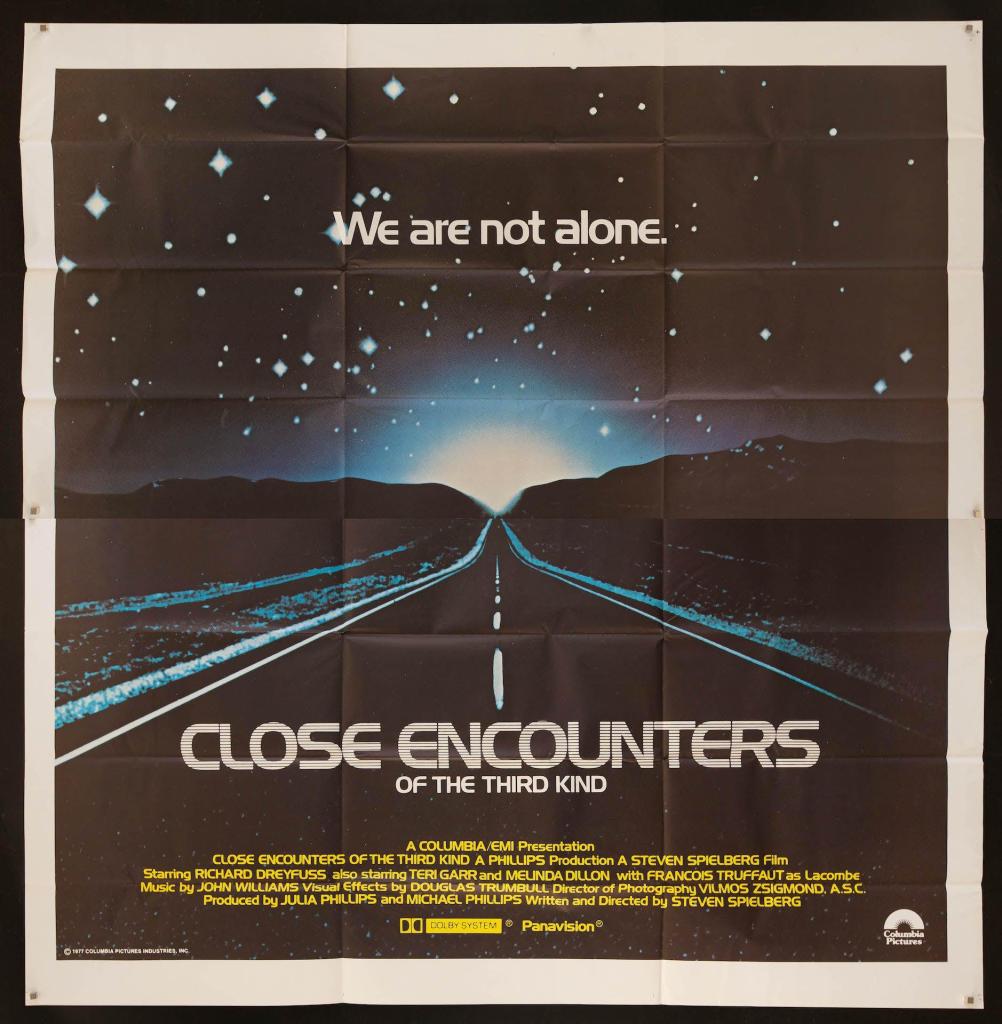

It reminded me of the scene in Steven Spielberg’s Close Encounters of the Third Kind.

There is a moment when the little boy, Barry, opens the door to the alien light flooding his house. The adults are terrified, scrambling to lock the windows, but Barry is just… open. He walks toward the blinding orange glow with a smile, saying simply, “Toys.” He doesn’t see a threat; he sees a wonder. He sees something new arriving.

The stock market this morning feels exactly like that open door. For days, the adults—the analysts, the bears, the “Blue Owl” financiers—have been terrified, locking the windows against the storm of debt and doubt. But today, the door swung open, and the light poured in.

II. The Memory of Light (Micron’s Signal)

The source of the light is Micron Technology ($MU).

Just like the blinding glow in the movie, Micron’s earnings report has flooded the pre-market with an undeniable intensity. The stock is up 15% this morning.

Why? Because they didn’t just beat expectations; they obliterated them.

- Revenue: Record-breaking.

- Guidance: Far above consensus.

- The Signal: They have sold out their entire supply of High Bandwidth Memory (HBM) for 2025 and 2026.

This is the “alien” truth that the bears missed. While everyone was worrying about financing for data centers, the engineers were quietly buying every memory chip in existence. The demand isn’t slowing down; it is accelerating so fast that the industry cannot keep up. Micron is telling us that the “AI Brain” is still growing, and it is hungry.

III. The Soft Hum of the Economy (CPI & The Fed)

If Micron is the blinding light, the economic data is the soft, reassuring hum of the spaceship.

The November CPI (Consumer Price Index) came in cooler than expected.

- Headline CPI: 2.7% (vs. 3.1% expected).

- Core CPI: 2.6% (the lowest since 2021).

The inflation monster, it seems, is sleeping. This unexpected drop has sent Treasury yields tumbling. The 10-year yield has fallen to 4.12%, a level we haven’t seen in weeks. The Fed now has a wide-open runway to cut rates. The terrifying noise of “higher for longer” has been replaced by the harmonious tones of a soft landing.

IV. The Fusion of Dreams (Trump Media)

And then, there is the strange, almost cinematic subplot. Trump Media ($DJT) is surging 25% this morning.

Why? They announced a merger with a nuclear fusion company, TAE Technologies.

It sounds like science fiction—a social media company buying a “mini-sun” to power the future. They plan to build a 50MW fusion reactor by next year. Whether this is real or just another scene from the movie, the market loves the story. It fits the narrative of “unlimited energy” for the AI revolution.

V. Conclusion: Walking Toward the Light

The S&P 500 is up 0.8%, the Nasdaq is up 1.4%. The “Santa Rally,” which seemed dead yesterday, has suddenly resurrected.

We stand at the door like Hunter, or like Barry in the movie. The adults in the room—the “smart money” managers with their 3.3% cash levels—spent the last few days frantically locking the windows, terrified of the wind, the debt, and the valuation. They saw the light outside as an invasion. They saw the alien ship and assumed it was coming to destroy the house.

But the market, in its innocence, just opened the door.

It saw the sold-out memory chips and the falling inflation and said, “Toys.”

Maybe that is the only way to survive a bull market this advanced. You have to suspend the cynical logic of the adult. You have to look at a fusion reactor merger or a 15% jump in a semiconductor stock not as a sign of a bubble, but as a sign of wonder.

The sun touched the world with gentle care this morning. It won’t last forever. Night will come again; the windows will rattle again. But right now, the light is warm, the mist is gone, and we are stepping outside.

Disclaimer: Lights can blind. Wonder is not a strategy. Invest with your eyes open.